Ross Young

Ross.Young@DisplaySupplyChain.com

FOR IMMEDIATE RELEASE: 06/05/2018

DSCC Releases Latest Display Equipment and Capacity Forecasts – LCD Overtakes OLED Spending in 2018 and 2019

Austin, TX -

Display Supply Chain Consultants (DSCC) has released its latest LCD and OLED equipment spending, capacity and supplier market share results and forecasts as part of its Quarterly Display Capex and Equipment Service (Q2’18 issue).

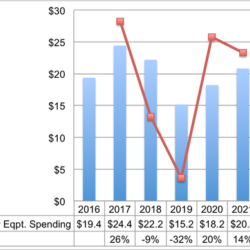

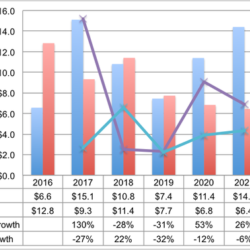

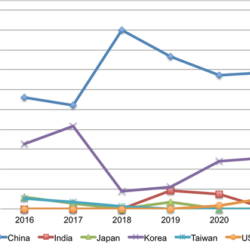

DSCC expects display equipment spending to fall 9% in 2018 as shown in Figure 1. Despite the decline, 2018 represents the 2nd best year ever for display equipment spending. By technology, LCD equipment spending is expected to grow 22% to $11.4B and overtake OLED spending which is expected to fall 28% to $10.8B as shown in Figure 2. LCD fabs will account for the majority of spending at 51% vs. 49% as LCD manufacturers gear up to produce 65” and 75” LCD TVs. As a result, equipment suppliers who are stronger in LCD equipment markets are likely to fare better in 2018 than companies focused on OLEDs where spending is slowing due to an oversupply in flexible OLEDs for mobile applications. 2018 will also benefit from upgrades for on-cell touch in OLEDs (Y-OCTA), multi mother glass adoption boosting the lithography equipment market and conversions to oxide for OLEDs and 8K TVs. China is expected to dominate spending in 2018 with a 90% share and should continue to outspend other countries through the forecast as shown in Figure 3. As a result, equipment suppliers who are stronger in China will fare better over the forecast. Korean equipment suppliers, who are dominant in Korea and weaker in China, are expected to lose share relative to 2016 and 2017.

In 2019, DSCC expects reduced spending in both OLEDs and LCDs as an oversupply persists in flexible OLEDs and worsens in TVs. LCD spending is expected to fall 32% with OLED spending down 31% resulting in a 32% decline to $15.2B. LCD spending is expected to maintain a slight 51% to 49% advantage. 2019 spending will also be impacted by tighter control of subsidies in China. Fabs in China are still expected to dominate spending however at 77%. While equipment revenues are expected to fall significantly in 2019, we do see bookings rising by 13% to $18.2B resulting in an improved book to bill ratio of 1.2 vs. 0.73 in 2018.

According to DSCC CEO Ross Young, “In 2020 and 2021, we expect strong demand for additional OLED capacity as OLEDs penetrate more applications and grow in size. We expect to see foldable OLEDs boost the average display size in the smartphone market and increase penetration into tablets and other markets. We also expect to see OLEDs gain penetration into automotive, notebooks and TVs which will drive demand for more capacity.”

In 2020, display equipment spending is expected to rise 20% to $18.2B with OLED spending up 53% and LCD spending down 12%. China is expected to 67% of spending as Korea boosts its share from 11% in 2019 to 24% in 2020.

We expect this trend to continue in 2021 with equipment spending up an additional 14% to $20.8B. OLED equipment spending is expected to rise another 26% to $14.4B with LCD spending down 6% to $6.4B.

From 2018 to 2021, BOE is expected to be the largest customer for equipment suppliers with a 26% share followed by China Star at 17% and LG Display at 15%.

From 2018 – 2021, exposure equipment is expected to be the #1 category with an 11% share followed by VTE at 6.3% and CVD with a 5.2% share. Design wins and market share are provided for every fab investment by equipment type from 2016 – 2022.

For more information about DSCC’s Quarterly Display Capex and Equipment Service which also includes an LCD and OLED capacity database/report, weekly PO and equipment awards and analysis of all publicly traded equipment and panel suppliers financial results, please visit: https://www.displaysupplychain.com/quarterly-capexequipment-service.html

About DSCC

DSCC, a Counterpoint Research Company, is the leader in advanced display market research with offices across all the key manufacturing centers and markets of East Asia as well as the US and UK. It was formed by experienced display market analysts from across the display supply chain and delivers valuable insights, data and supply chain analyses on the display industry through consulting, syndicated reports and events. Its accurate and timely analyses help businesses navigate the complexities of the display supply chain.