Ross Young

Ross.Young@DisplaySupplyChain.com

FOR IMMEDIATE RELEASE: 12/21/2017

DSCC Reports Quarterly OLED Revenues Surpass $5B for the First Time in Q3’17 - Expected to Grow 88% in Q4’17 to $10B and Approach $80B in 2022

Austin, TX -

Display Supply Chain Consultants (DSCC) has released the first issue of its Quarterly OLED Shipment and Fab Utilization Report that raises the bar on OLED market insights.

Covering all OLED suppliers and all applications, this new report provides shipments, prices and revenues by panel supplier by application by customer by size by resolution for Q1’16 – Q3’17 with projections through Q4’18. The report also forecasts the market on an annual basis from 2016 – 2022.

There are numerous highlights from this report including:

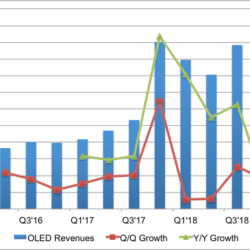

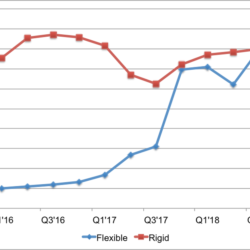

- Quarterly OLED revenues exceeded $5B for the first time in Q3’17 and are expected to rise 88% Q/Q and 153% Y/Y in Q4’17 to $10.0B as shown in Figure 1. Flexible smartphone OLEDs are driving the revenue growth on pent-up demand for the iPhone X. Flexible OLED display revenues rose 37% Q/Q in Q3’17 and are expected to grow 140% Q/Q in Q4’17. The flexible OLED unit share of the OLED smartphone market rose from 29% in Q2’17 to 33% in Q3’17 and is expected to reach 49% in Q4’17 with units shown in Figure 2 with the revenue share rising from 56% in Q2’17 to 66% in Q3’17 and a projected 80% share in Q4’17 on significantly higher prices.

- Samsung was the top OLED panel supplier in Q3’17 with a 91% share, which is expected to rise to 93% in Q4’17 on higher flexible OLED output. Samsung was also the #1 customer of OLED panels in Q3’17 with a 42% share. However, in Q4’17, strong iPhone X as well as Touch Bar and Smart Watch shipments will enable Apple to overtake Samsung with a 57% to 26% advantage.

- For 2017, OLED revenues are expected to rise 64% to $24.3B.

- After the spike in demand in Q4’17, OLED revenues are expected to decline 11% in Q1’18 and 10% in Q2’18 on seasonal weakness and high flexible OLED smartphone prices limiting demand in China. Double-digit sequential growth is expected in seasonally strong Q3’18 and Q4’18 as both rigid and flexible OLED smartphones proliferate and OLED TV capacity grows. For 2018, OLED revenues are expected to rise 56% to $37.7B.

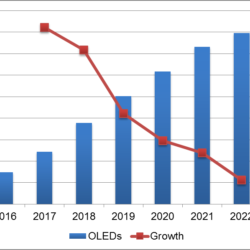

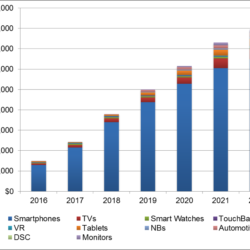

- Through 2022, OLED revenues are expected to continue to surge as OLEDs increasingly penetrate more applications and capacity continues to surge. OLED revenues are expected to grow at a 32% CAGR from 2016 to 2022 to $79.5B as shown in Figures 3 and 4 with TVs rising at a 34% CAGR, smartphones rising at 31% and a host of other applications grow at faster rates including tablets, notebooks, monitors and automotive.

- Samsung is expected to remain the dominant OLED panel supplier in 2018 with an 87% share, down from 92% in 2017, which includes TVs.

- In the TV market, LG is expected to dominate both in panels and TV sets. The OLED TV panel market is expected to grow at a 48% CAGR from 2016 to 2022 to 9.5M units. The report reveals the share of OLED TV panels purchased by TV brand with LG and Sony leading in 2017 with a combined 84% share.

- OLED fab utilization fell from 82% in Q2’17 to 72% in Q3’17 and is expected to be 85% in Q4’17.

DSCC’s Quarterly OLED Shipment and Fab Utilization Report allows its subscribers to examine the outlook for the entire OLED market for each application in units, ASPs and revenues by panel supplier and customer. Subscribers can also track the health of each OLED supplier by tracking their fab utilization and shipment and revenue outlook. Deliverables include multiple pivot tables and databases and a Powerpoint Report. For more information, please contact Dustin@DisplaySupplyChain.com or (832) 451-4909.

About DSCC

DSCC, a Counterpoint Research Company, is the leader in advanced display market research with offices across all the key manufacturing centers and markets of East Asia as well as the US and UK. It was formed by experienced display market analysts from across the display supply chain and delivers valuable insights, data and supply chain analyses on the display industry through consulting, syndicated reports and events. Its accurate and timely analyses help businesses navigate the complexities of the display supply chain.