DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 05/15/2023

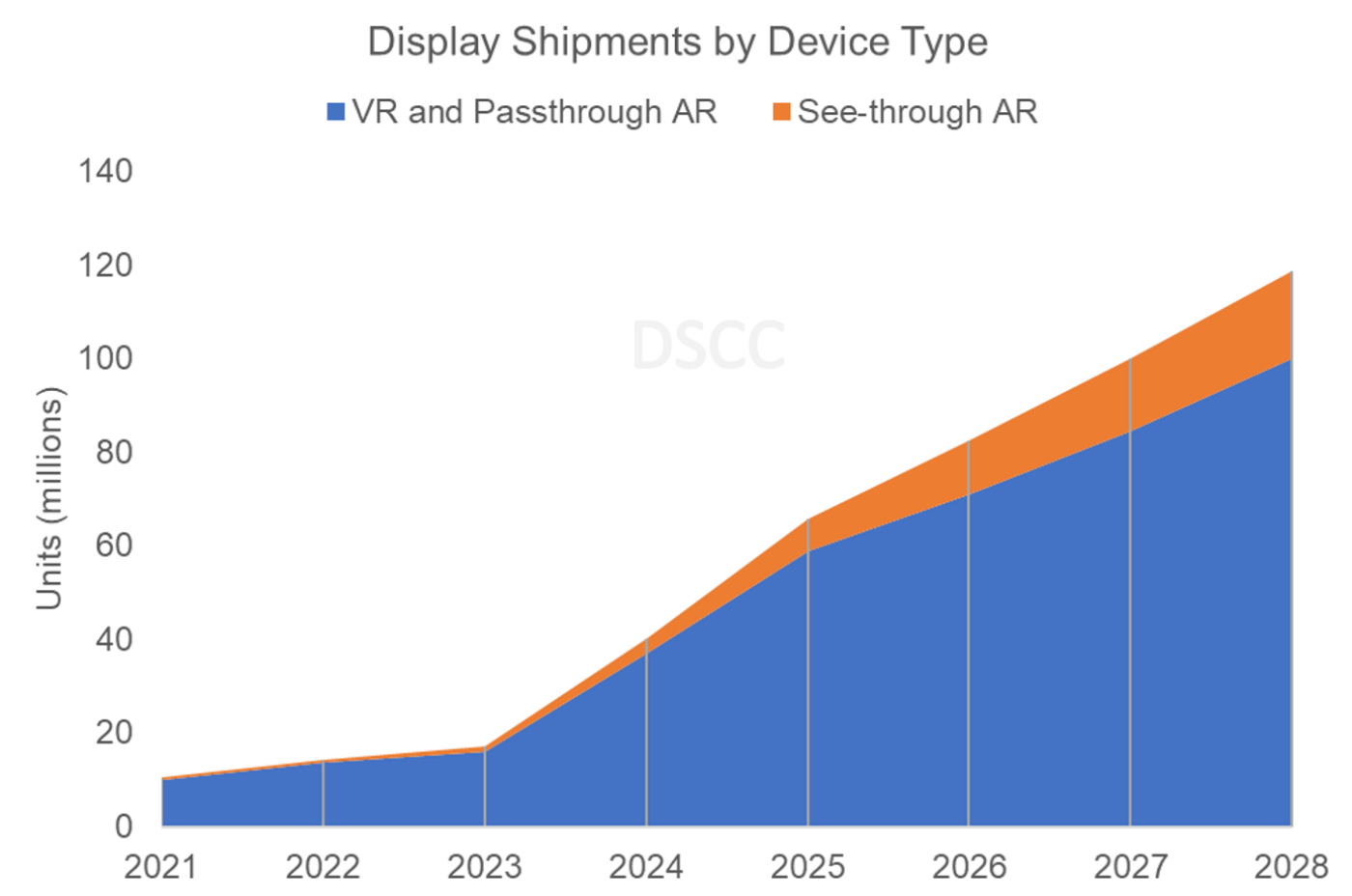

AR/VR Panel Shipments to Reach 119M Units by 2028

La Jolla, CA -

Display panel shipments for Virtual Reality (VR) will increase by 17.6% this year, according to the latest issue of the Biannual Augmented and Virtual Reality Display Technologies and Market Report. DSCC expects panel shipments to grow from 13.6M units in 2022 to 16M units in 2023.

According to DSCC's Guillaume Chansin, Director of Display Research, "The increase in panel shipments is lower than previously forecasted. We initially assumed that the launch of new headsets such as the Meta Quest Pro and the Pico 4 would significantly boost panel shipments due to their dual LCD configuration. However, we understand that sales of these devices have been extremely disappointing so far."

It is also too early to tell whether the Sony PSVR2 will be a success. Sony missed the holiday season and only started shipping the headset in February. Although the device has won some praise thanks to its high-resolution AMOLED panels, the PSVR2 is a relatively expensive accessory for the PlayStation 5 and cannot be used with other gaming systems. AMOLED panels started shipping last year and DSCC expects production rate to be slightly lower in 2023.

The long-term outlook remains optimistic, but with a slower pace of growth. DSCC forecasts AR/VR display shipments to reach 119M units by 2028, with VR as the larger segment. The assumption is that 2024 will see significant growth thanks to new headsets powered by the upcoming Qualcomm Snapdragon XR2 Gen2. Meta has already confirmed the launch of the Quest 3 by the end of the year. Samsung has also been developing its own headset and could re-enter the market after a long absence.

Apple is also expected to launch a headset, but volumes will be low initially. Apple is using high resolution OLED-on-Silicon (SiOLED) displays, also known as Micro OLED. Apple has delayed the product launch several times and there is still some speculation on whether it will be officially announced at the Worldwide Developers Conference (WWDC) in June. Even if Apple unveils the device next month, production is unlikely to start until much later this year. Revenues for SiOLED displays in 2023 are now expected to be lower than previously forecasted.

SiOLED is already used by Chinese brands in so-called Smart Viewers. These see-through AR devices enable users to project virtual monitors to watch content. For VR, the display size needs to be larger so the cost of using SiOLED is significantly higher. Several Chinese manufacturers have invested to increase production capacity and reduce cost. Samsung Display has also started building a pilot line and will start production later this year.

DSCC provides the most comprehensive market research for the display industry. This latest report gives a complete picture of the various display technologies used in AR/VR, including LCD, AMOLED, LCoS, DLP, LBS, MicroLED and SiOLED. It profiles the key suppliers and their roadmaps. Market forecasts for both AR and VR are segmented by display types and show the technologies that will generate the most revenues. For inquiries, please email お問い合わせ窓口.

DSCC will also be hosting the third edition of the AR/VR Display Forum on September 12-13, 2023. This virtual event will cover the latest progress to manufacture and commercialize the displays that will enable immersive AR and VR headsets with high resolution, wide field of view and longer battery life. If you would like to become a speaker or sponsor at the event, please contact DSCC.

About DSCC

DSCC, a Counterpoint Research Company, is the leader in advanced display market research with offices across all the key manufacturing centers and markets of East Asia as well as the US and UK. It was formed by experienced display market analysts from across the display supply chain and delivers valuable insights, data and supply chain analyses on the display industry through consulting, syndicated reports and events. Its accurate and timely analyses help businesses navigate the complexities of the display supply chain.