DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 11/07/2022

MicroLED: Have We Reached the Bottom of the Hype?

La Jolla, CA -

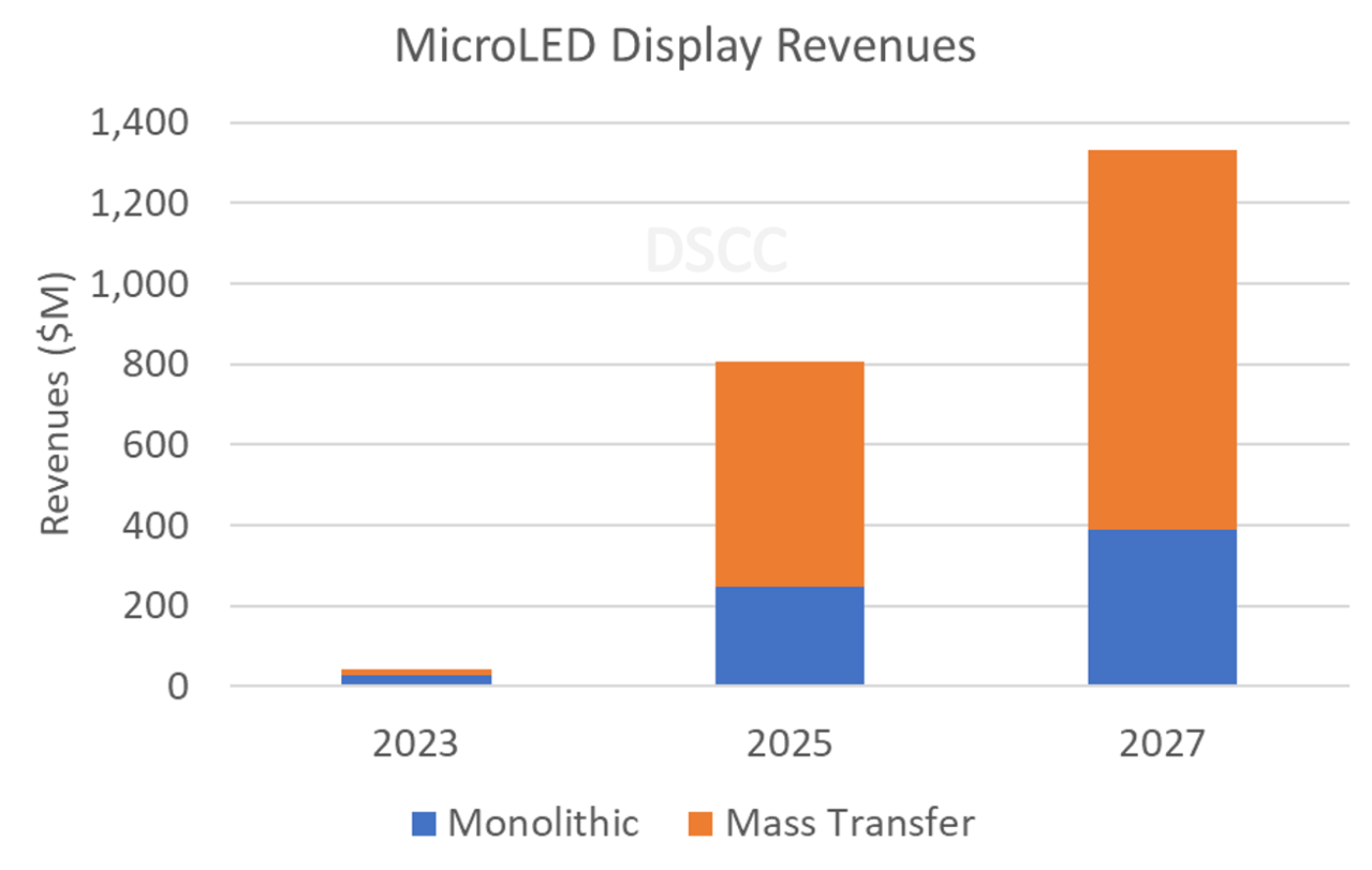

The market for MicroLED displays is still tiny but could reach $1.3B by 2027, according to DSCC’s latest MicroLED Display Technology and Market Outlook Report. Lowering manufacturing costs will be necessary before MicroLED can become competitive against other technologies, such as OLED.

“MicroLED was initially presented as an ideal display technology for all applications but the hype has faded,” according to Guillaume Chansin, Director of Display Research at DSCC. “OLED has conquered the smartphone market and keeps getting better, while LCD still offers unbeatable value for money. MicroLED is currently only available as an oversized TV or a miniature projector for smart glasses.”

MicroLED displays are based on inorganic light emitting diodes (LED) that are smaller than 100 μm. Because of their size, they can be packed at high density to produce self-emissive pixels. MicroLED displays can potentially deliver high efficiency, high brightness, a short response time and a long lifetime.

Some companies currently advertise LED video walls as MicroLED displays. However, the chip-on-board (COB) method used by these displays is closer to the MiniLED technology found in some LCD backlights.

MicroLED displays can be manufactured by mass transfer of a large number of individual LED chips onto a display substrate. This requires specialized tools with high accuracy and high throughput. Although there have been several demos of MicroLED displays made by mass transfer, the only product on the market is Samsung’s MicroLED TV.

At CES 2022, Samsung announced a new lineup of MicroLED TVs. However, the launch has been delayed, most likely because of the low production yield. According to the DSCC report, the price of MicroLED TVs is expected to remain too high to get a significant market share in TV in the next five years. This year, Samsung has also launched QD-OLED as a premium TV display technology.

Apple has been working on MicroLED technology since acquiring LuxVue, a startup developing a mass transfer technique, back in 2014. However, Apple does not appear to be in any rush to introduce MicroLED into its products. Apple is increasingly relying on LTPO OLED for high end mobile devices, including the $799 Apple Watch Ultra. LTPO is a backplane technology that reduces power consumption at low refresh rates, such as with always-on displays.

The small size and low pixel count of smart watches is an advantage for MicroLED mass transfer. DSCC expects that Wearables will ultimately become the largest segment for MicroLED displays.

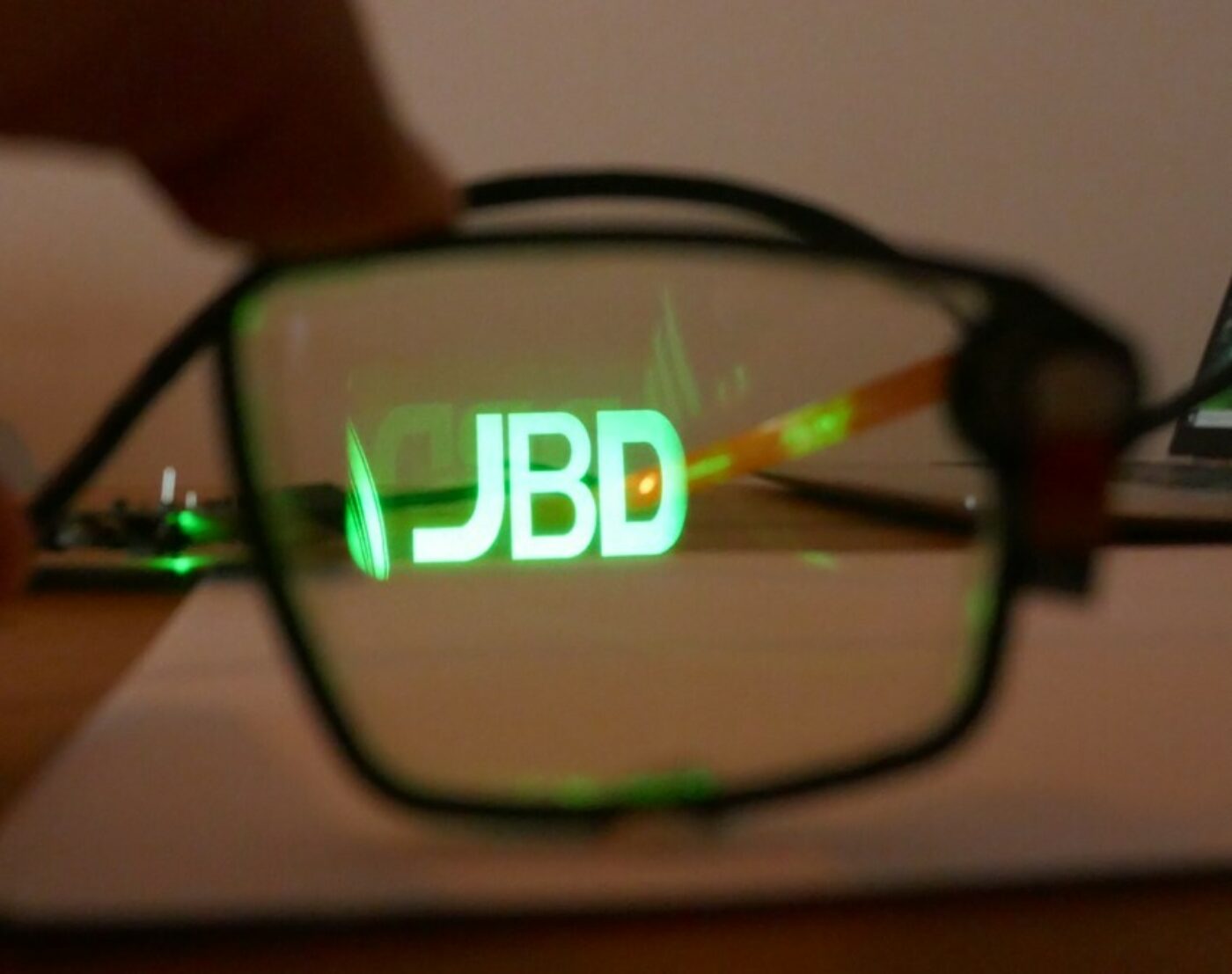

One category which still enjoys relatively strong hype is AR/VR. The combination of MicroLED with diffractive waveguides is currently presented as the best route to achieve lightweight smart glasses with a see-through AR display. MicroLED can offer the high brightness and small footprint required for this application.

Vuzix has already announced the first pair of smart glasses that integrates a MicroLED projector, in partnership with Jade Bird Display. Meta is developing its own MicroLED technology. Earlier this year, Google acquired MicroLED startup Raxium.

For AR/VR, the MicroLED displays will be manufactured in a monolithic fashion to achieve a high pixel density. However, producing a full color display remains a tricky challenge. There are several solutions currently on the table, which are all described in the report.

The DSCC report includes market forecasts to 2027 and addresses all the important topics on MicroLED, including:

- Epitaxy and efficiency challenges;

- Mass transfer technologies;

- Yield and defect management strategies;

- Color conversion with quantum dots;

- Backplanes and driving schemes;

- Monolithic displays;

- Cost analysis (epiwafers, backplanes, QD color conversion, transfer costs);

- Competitive landscape.

Companies covered in the report include: Samsung, Apple, Meta, Snap, Google, Vuzix, PlayNitride, AUO, Sharp, Ennostar, X Display, VueReal, Coherent, Kulicke & Soffa (K&S), eLux, Nanosys, Aledia, MICLEDI, Mojo Vision, Porotech and Jade Bird Display.

This report will be valuable to anyone in the display supply chain and end users who may want to adopt MicroLED displays in future products. It lists the OEMs currently developing products incorporating MicroLED displays and provides shipment and revenue forecasts for each application.

For more information on DSCC’s MicroLED Display Technology and Market Outlook Report, please contact info@displaysupplychain.com.

About DSCC

DSCC, a Counterpoint Research Company, is the leader in advanced display market research with offices across all the key manufacturing centers and markets of East Asia as well as the US and UK. It was formed by experienced display market analysts from across the display supply chain and delivers valuable insights, data and supply chain analyses on the display industry through consulting, syndicated reports and events. Its accurate and timely analyses help businesses navigate the complexities of the display supply chain.