Ross Young

ross.young@displaysupplychain.com

FOR IMMEDIATE RELEASE: 04/26/2021

SID/DSCC Business Conference Keynote Session Will Be a Highlight

Austin, TX -

The 2021 SID/DSCC Business Conference at DisplayWeek, sponsored by Applied Materials, Corning, GE, OTI, Radiant Vision Systems and TOK, is now less than a month away. It will feature 40 different talks on all aspects of the display industry.

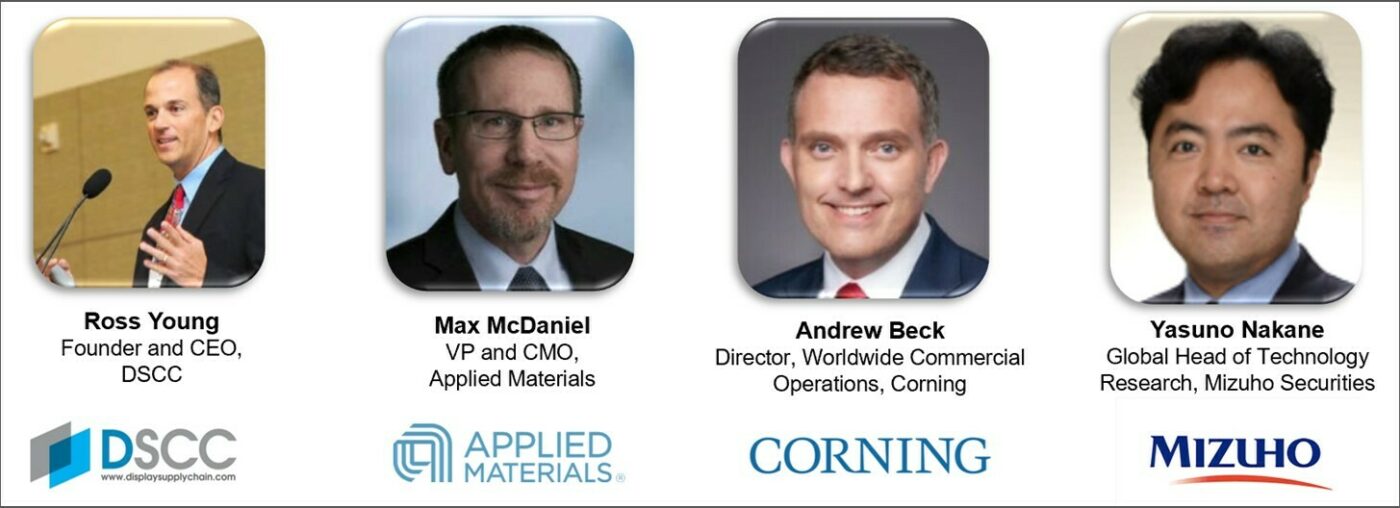

Four of the most anticipated talks will occur in the keynote session. The keynotes are shown below:

Each keynote’s talk is summarized below:

Ross Young, CEO, DSCC. Ross’s talk is entitled “Forecasting the Post COVID-19 Display Market – Outlook Has Never Been Better.” According to his abstract:

COVID-19 accelerated a number of key trends which benefited the display industry. Demand has surged as students and workers communicate more than ever through their displays at home rather in person leading to strong growth in notebook, monitor and tablet demand. In addition, funds that may have been spent on travel and leisure are being reallocated to purchases of bigger and better TVs and other display products. COVID-19 has likely pulled forward significant demand and has led to strong unit growth, tighter supply, higher prices, higher profits and upgraded capex and capacity. It has also accelerated interest in emerging technologies which can improve display performance and disrupt the existing display supply chain. Of critical importance is how long these trends are expected to last and whether prices will fall as fast as they have risen. Is the display industry poised for a downturn or will the good times continue to roll?

This talk will quantify the latest forecasts for the display industry including units, revenues and area by application. It will also examine where prices, costs and margins are likely headed in the rest of 2021 as well as 2022 – 2025. It will also try to identify which segments and companies are best positioned for success. Our thesis is that times have never been better for the display industry. The desire for companies to shut down significant LCD capacity once prices start to fall and convert to potentially higher margin OLEDs and other technologies will minimize the downturn. In addition, the emergence of miniLEDs will boost LCD ASPs for a growing number of products from tablets to TVs which should boost the revenue outlook for LCD suppliers and make for some very interesting competition with OLEDs in numerous segments. It is a great time to be in the display industry.

Max McDaniel, VP and CMP, Applied Materials. Max’s talk is entitled “Enabling Future Display Technologies and the OLED Wave.” According to his abstract:

Through the history of the display industry, we see a repeating pattern of display technology substitution. Each new technology inflection follows a familiar pattern. First, it drives significant improvements in user experience, image quality, screen size, and/or form factor. Second, the new technology begins at the high end, then diffuses towards wider mainstream adoption with increased maturity and reduced costs. Third, each new technology brings new device and manufacturing challenges that panel makers and their technology partners like Applied Materials help to solve. Fourth, we also see a trend of increasing complexity and “process intensity” with each new advanced technology, as components are replaced by in-fab process steps.

We are once again at an inflection point in the evolution of display technologies. In mobile, OLED is winning the battle versus LCDs and all new fab investments are OLED. Now the focus is on enabling more advanced OLED technologies (like foldable) even as rigid and flexible OLED continue to replace LCD. In large area displays like TV and IT, OLED is also emerging to challenge LCD’s dominance, while LCD makers mount a stout defense with extending technologies like mini-LED backlights. Ultimately, we expect OLED to overtake LCD in large area as well as in mobile over the next several years in what we call the “OLED Wave”, which will continue for the next decade or more, until even more advanced displays like micro-LED and natural 3D reach sufficient maturity.

Whichever technologies ultimately win adoption, Applied Materials will be a key enabler in partnership with our customers. Advanced displays need advanced backplane processes, with more layers and more challenging specifications. Our integrated materials solutions (IMS) are optimized for LTPS, MOx, LTPO, in-cell/on-cell touch, and more. We are excited to work with customers and partners to help bring new and superior displays to the market faster, with higher yield and lower cost.

Andrew Beck, Director, Worldwide Commercial Operations, Corning Display. Andrew’s talk is entitled “A New Age for Display Glass.” According to his abstract:

Display glass demand is at an all-time high, according to some reports, thanks to a perfect storm of conditions that emerged into 2021. What does this mean for the industry and what should we expect going forward? Corning Display’s commercial director, Andrew Beck, shares the company’s views on demand drivers, glassmakers’ responses and a potential new normal for displays post-pandemic.

Yasuo Nakane, Global Head of Technology Research, Mizuho Securities. Nakane-san’s talk is entitled “Flat Panel Display Industry Outlook.” According to his abstract:

He will share their latest forecasts for the flat panel display (FPD) industry. In particular, I will discuss the outlook for finished products (e.g., smartphones, tablets, notebooks and TVs) and major brands (e.g., Samsung and Sony) panel demand and the FPD industry from the viewpoint of brand strategy. At the same time, he will analyze how the FPD industry is affected by the strategies of the main brands (Samsung, Apple and Chinese majors). He will also analyze the competitive axes (between regions, companies, OLED and LCD technologies, semiconductor battles) between panel manufacturers and discuss panel makers’ future strategies, industry direction and the impact on the value chain including materials and equipment.

“While these talks are sure to deliver great insight, DSCC analysts will also follow up with interviews of each speaker after the event which will be posted on the SID event site after the event. Attendees will be able to submit their questions for each keynote in advance of the interviews,” said Ross Young, Founder and CEO of DSCC. For more information on what will be a great event including registering, please visit https://www.displaysupplychain.com/events/sid-dscc-2021-virtual-business-conference-at-displayweek or contact info@displaysupplychain.com.

About Display Week 2021

The 58th Display Week, presented by the Society for Information Display (SID), will take place May 17-May 21. Display Week is the world's leading event focused on emerging electronic display and visual information technologies from concept to market. Display Week attracts attendees from the entire ecosystem of R&D, engineering, design, manufacturing, supply chain, marketing, sales and financial, as well as commercial and consumer end-user markets. It delivers unparalleled learning opportunities, market-moving trends, sourcing, roadmaps-to-market, and connections for career and business growth. For more information on Display Week 2021, visit www.displayweek.org or follow us on LinkedIn, Facebook, Twitter @DisplayWeek (hashtag #DisplayWeek2021), Instagram @siddisplayweek or the Display Week YouTube Channel.

About SID

The Society for Information Display (SID) is the only professional organization focused on the electronic display and visual information technology industries. In fact, by exclusively focusing on the advancement of electronic display and visual information technologies, SID provides a unique platform for industry collaboration, communication and training in all related technologies while showcasing the industry's best new products. The organization's members are professionals in the technical and business disciplines that relate to display research, design, manufacturing, applications, marketing and sales. To promote industry and academic technology development, while also educating consumers on the importance of displays, SID hosts more than 10 conferences a year, including Display Week, which brings industry and academia all under one roof to showcase technology that will shape the future. SID's global headquarters are located at 1475 S. Bascom Ave., Ste. 114, Campbell, CA 95008. For more information, visit www.sid.org.

About DSCC

DSCC, a Counterpoint Research Company, is the leader in advanced display market research with offices across all the key manufacturing centers and markets of East Asia as well as the US and UK. It was formed by experienced display market analysts from across the display supply chain and delivers valuable insights, data and supply chain analyses on the display industry through consulting, syndicated reports and events. Its accurate and timely analyses help businesses navigate the complexities of the display supply chain.