DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 03/11/2024

Demand for Premium Displays Pushes Quantum Dot Revenues to New Highs

La Jolla, CA -

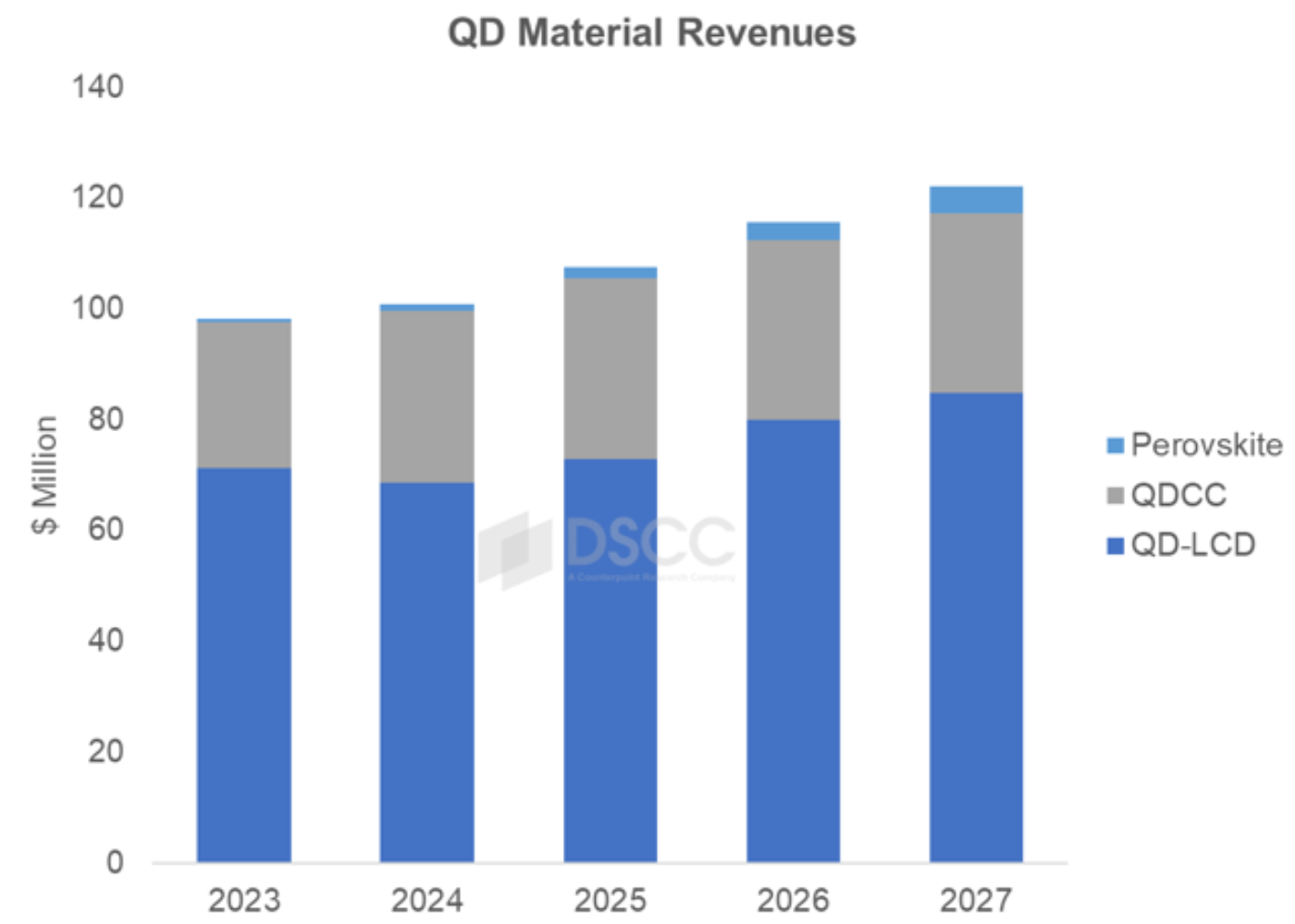

- Quantum dot market to expand from $100M in 2024 to $122M in 2027.

- Material consumption for QD-OLED production now accounts for 31% of revenues.

- Perovskite and EL-QD technologies offer new opportunities for future growth.

Revenues for quantum dot materials in display panels will top $100M this year, according to DSCC’s latest Quantum Dot Display Technology and Market Outlook Report. Demand for quantum dots continues to grow, thanks to the rise of MiniLED and QD-OLED technologies in TV and monitors. DSCC forecasts that revenues will reach $122M by 2027.

“Since its launch in 2022, QD-OLED has become the most highly rated display technology for TV” says Guillaume Chansin, lead analyst on the report. “Capacity remains limited so we expect only 2M QD-OLED panels will be produced in 2024. Despite the small volume, QD-OLED has significantly helped boost material consumption and now accounts for 31% of quantum dot revenues.”

To make QD-OLED panels, Samsung Display has pioneered the use of quantum dot color converters (QDCC). These are inkjet printed on each pixel during manufacturing, using ink formulations that are loaded with quantum dots. Compared to QD-LCD panels, QD-OLED requires a larger quantity of quantum dots per area.

The report also predicts perovskite materials capturing some market share. Perovskites are often described as a new class of quantum dots because they offer better performance. Green perovskite is available but red perovskite is still under development, so it is often paired with a red phosphor. The technology is currently in the early stage of commercialization and the supply chain will take some time to build.

OLED remains the biggest rival to quantum dot displays. LG Display continues to improve its White OLED technology and has even agreed to a supply deal with Samsung. OLED adoption is also growing rapidly in laptops as consumers seek the same high contrast and wide color gamut of a smartphone display.

The potential contestant against OLED is electroluminescent quantum dots (EL-QD). Unlike QD-OLED, this technology does not require a blue OLED stack since the quantum dots emit light directly instead of converting colors. At CES 2024, Nanosys and Sharp were demonstrating new prototypes of EL-QD displays. While there is no plan for mass production in the near future, EL-QD technology could enable growth in quantum dot materials beyond 2027.

The latest Quantum Dot Display Technology and Market Outlook Report includes updated market forecasts, as well as an analysis on the following topics:

- Different types of QDs that are useful for display applications.

- The European Union's Regulatory of Hazardous Substances (RoHS) imperative and implication in each type of QD architecture.

- Cost breakdown and revenues forecasts for quantum dot films and quantum dot materials.

- Advantages and challenges of manufacturing QDCC by photolithography and inkjet printing.

- Progress in perovskites.

- QD-OLED fab capacity and display structure.

- Applications of QDCC in MicroLED displays.

- Progress in EL-QD (demos, EQE and lifetime).

About DSCC

DSCC, a Counterpoint Research Company, is the leader in advanced display market research with offices across all the key manufacturing centers and markets of East Asia as well as the US and UK. It was formed by experienced display market analysts from across the display supply chain and delivers valuable insights, data and supply chain analyses on the display industry through consulting, syndicated reports and events. Its accurate and timely analyses help businesses navigate the complexities of the display supply chain.