Ross Young

Ross.Young@DisplaySupplyChain.com

FOR IMMEDIATE RELEASE: 09/28/2020

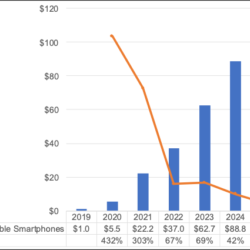

DSCC Forecasts Foldable and Rollable Smartphone Revenues to Exceed $100B in 2025

Austin, TX -

DSCC has released its Quarterly Foldable/Rollable Display Shipment and Technology Report which provides detailed shipment results and forecasts for foldable and rollable smartphones, notebooks and tablets on a unit, revenue and area basis. It also includes detailed product analysis, brand roadmaps, panel BoM forecasts and a detailed examination of UTG and CPI cover materials.

The report forecasts an 80% CAGR increase in foldable/rollable smartphone revenues from 2020 to 2025 to $105 billion. This is clearly one of the fastest growing categories in consumer electronics. The display area is expected to rise at a 93% CAGR to 1.2M square meters in 2025. Units are expected to grow at an 86% CAGR to 74.4M units with ASPs declining at 6% per year. Smartphone brands will look to keep prices high for this segment over the next 5 years by adopting larger sizes, multiple folds, new rollable/slidable/extendable mechanisms, improving robustness, offering better cameras, adopting under panel cameras, etc.

According to DSCC CEO Ross Young, “The recent success of the Samsung Galaxy Z Flip and Z Fold 2 has boosted the outlook for foldable devices and diminished the robustness concerns many users previously had. As a result, we see foldable devices becoming more broadly adopted in the future. In addition, we see developments coming beyond single fold devices. Multi-fold and rollable/slidable/extendable devices are also of interest to multiple brands we have talked to. Multi-folds will enable even larger displays to penetrate the smartphone market. Regarding rollable, while foldable displays must manage a tight fold radius and significant stress in a specific area (the crease), rollable displays will face a larger radius and less stress but over the entire area. This may involve changes to panel design requirements but could end up resulting in higher yields and lower material costs. The larger bend radius should be easier for UTG and CPI suppliers. It could allow for thicker UTG optimized for scratch resistance and not requiring a soft protective layer that is more prone to scratches. Since the rollable display will be curved behind itself, it will be thicker than a conventional smartphone, but because it isn’t folded over, it should be thinner than a foldable phone. We are seeing multi-fold and rollable solutions in company roadmaps not just for smartphones, but notebooks and tablets as well. The future looks very exciting for flexible displays which will help consume the excess capacity currently in place.”

The monthly results show smartphone shipments in units, revenues, ASPs and area by month/quarter/year for the following parameters:

- Brand

- Model

- Form Factor

- Panel Supplier

- Average Size

- Resolution

- Aspect Ratio

- DPI

- Refresh Rate

- Backplane

- Cover Window Material

- UTG Supplier

- CPI Supplier

- HC Supplier

- Touch Type – Add-on vs. Integrated

- Touch Sensor Supplier

- AP Supplier

- AP Model

- Main Camera

- Front Camera

- Battery

- Cellular Network

- Min. Memory

- Min. Storage

- Polarizer Supplier

- Weight

- List Price

- Price Band

The forecast shows shipments in units, revenues, area and ASPs for the following parameters:

- Brand

- Model

- Panel Supplier

- Form Factor

- Average Size

- Resolution

- Aspect Ratio

- Refresh Rate

- Backplane

- Cover Window Material

- List Price

- Price Band

The report also features :

- A detailed analysis of all existing foldable products including analyses of their film stacks and the thickness and suppliers of each layer.

- Product roadmaps for 15 brands;

- Detailed panel bill of materials cost forecast through 2025 including UTG and CPI costs.

For more information on DSCC’s Quarterly Foldable/Rollable Shipment and Technology Report, please contact info@displaysupplychain.com.

About DSCC

DSCC, a Counterpoint Research Company, is the leader in advanced display market research with offices across all the key manufacturing centers and markets of East Asia as well as the US and UK. It was formed by experienced display market analysts from across the display supply chain and delivers valuable insights, data and supply chain analyses on the display industry through consulting, syndicated reports and events. Its accurate and timely analyses help businesses navigate the complexities of the display supply chain.