Guillaume Chansin

guillaume@displaysupplychain.com

FOR IMMEDIATE RELEASE: 04/19/2021

DSCC Forecasts Rapid Growth for AR/VR Displays

Austin, TX -

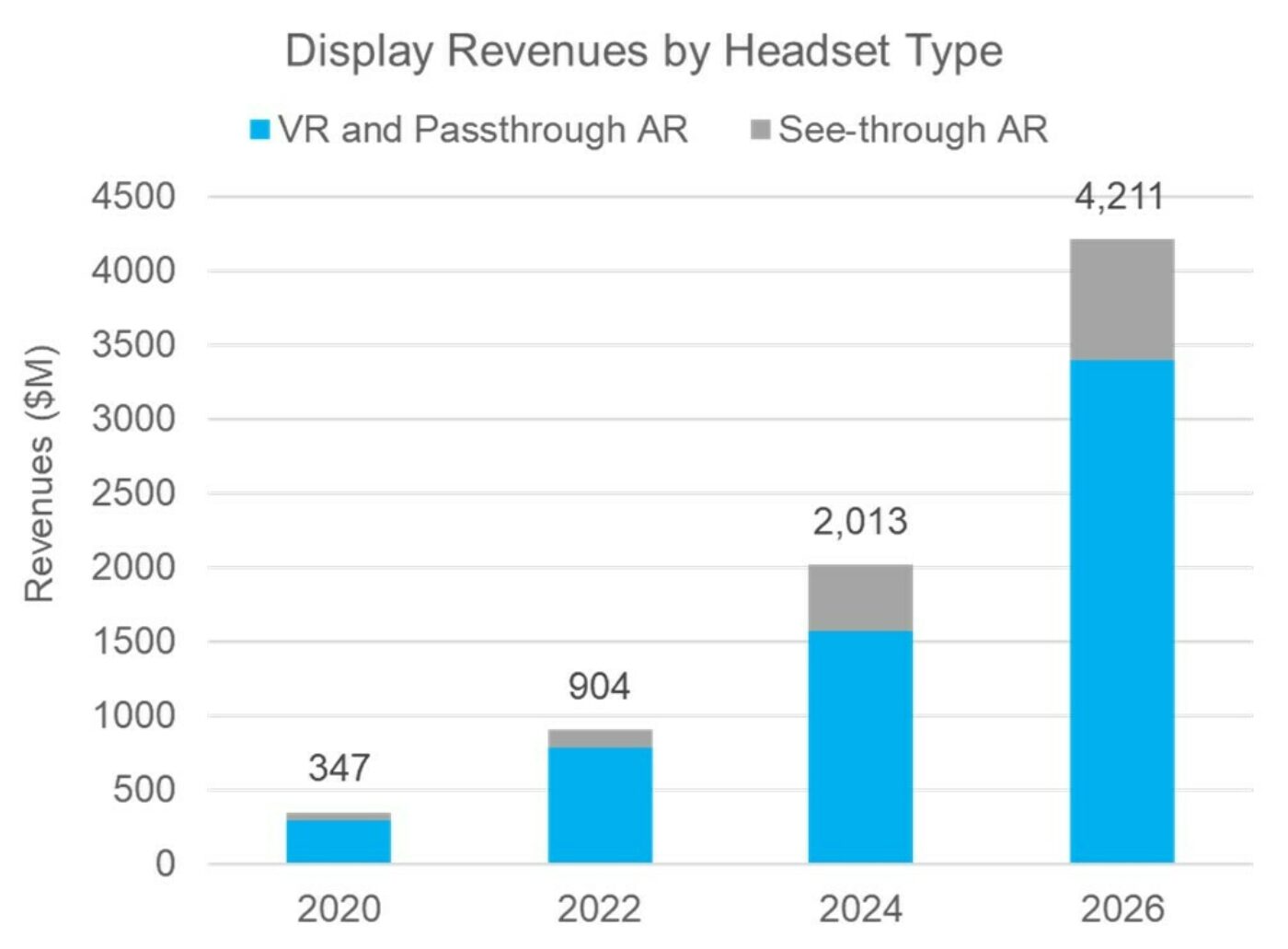

Augmented Reality (AR) and Virtual Reality (VR) will become a multi-billion opportunity for display manufacturers, according to a new report released by DSCC. Annual revenues for AR/VR displays will grow at a CAGR of 52% to reach $4.2B in 2026. The report also shows the market share for each technology and predicts that OLED-on-Silicon (SiOLED) become more popular over time.

“There are several trends driving this growth” says Guillaume Chansin, Director of Display Research at DSCC. “First, major brands with strong ecosystems like Apple and Sony are planning to release new headsets. Recently released devices such as the Oculus Quest 2 or the Nreal Light have also redefined the entry level experience and pricing for consumer VR and AR. There are now better components designed specifically for head-worn devices instead of smartphones and the roll out of 5G should enable more content to be delivered. Finally, investment in new display technologies will lead to a new generation of headsets with compelling visual performance and more compact form factors.”

DSCC defines AR as a broad category of technologies, including what some vendors call Mixed Reality (MR). Unlike VR which provides an immersive virtual environment, AR consists of combining digital images with the real world. AR can be implemented either using optical combiners (see-through AR) or with a live video feed (passthrough AR).

Various solutions exist for see-through AR, such as diffractive waveguides and birdbath optics. For instance, Microsoft adopted laser beam scanning (LBS) with waveguides for the HoloLens 2. Recently, Qualcomm introduced a reference design based on SiOLED microdisplays. However, each configuration brings its own set of compromises. The brightness of the display has remained a long-standing issue, in particular when using the device in daylight. The introduction of high brightness MicroLED displays will create new opportunities in see-through AR.

Passthrough AR, while less visually impressive, has the advantage of being less demanding on the display. VR headset manufacturers can include AR functionality by adding cameras, thereby offering a 2-in-1 device. Apple is likely to implement passthrough AR in its upcoming headset.

DSCC expects VR and passthrough AR to generate more display shipments and revenues than see-through AR. In 2022, display revenues for VR and passthrough AR will be $778M, more than six times the revenues for see-through AR at $126M. By 2026, the ratio between these two categories will still be more than four-fold.

The DSCC report focuses on the Consumer and Enterprise markets. Military applications are not covered in the forecasts.

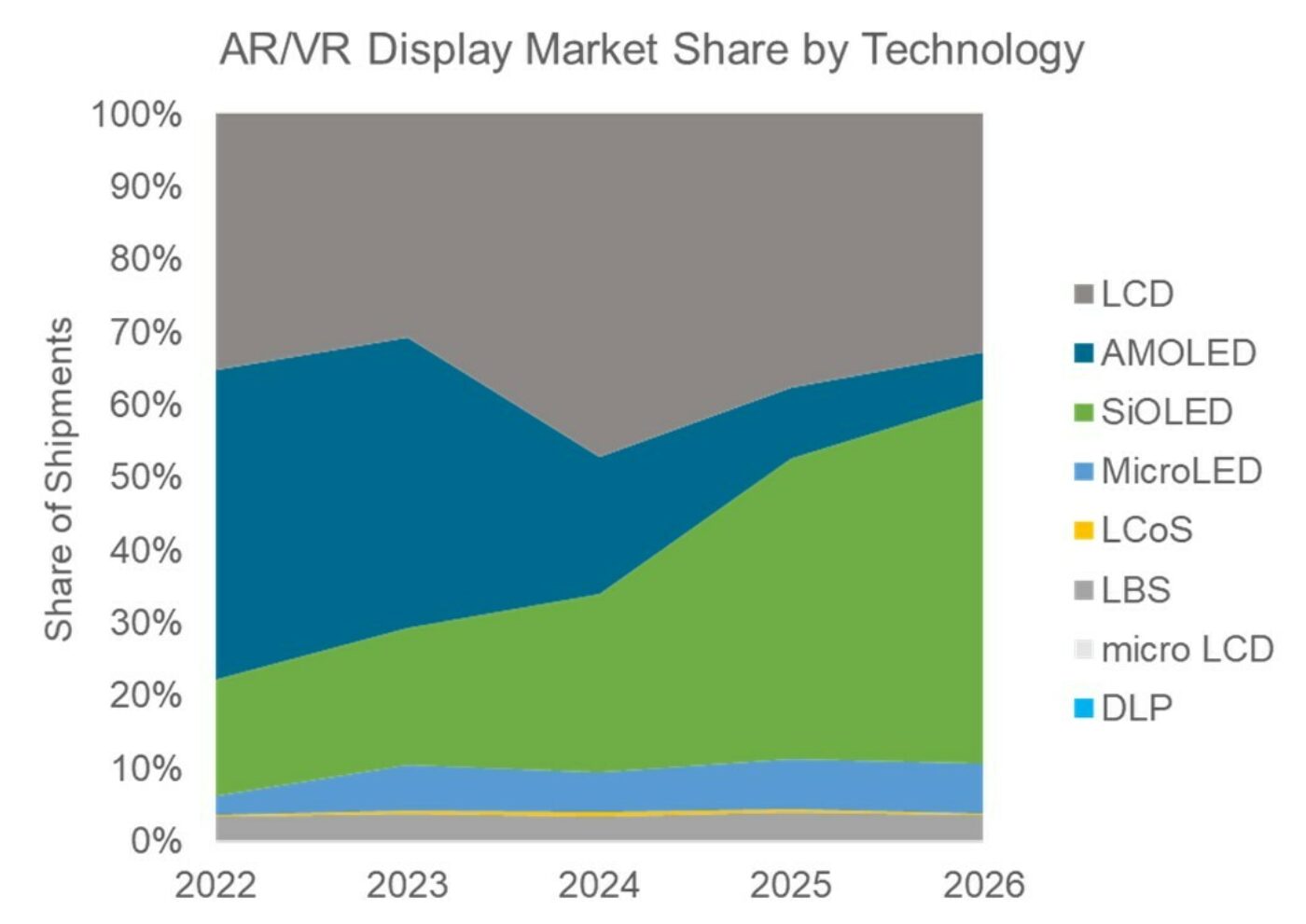

DSCC also predicts that SiOLED will capture the largest share of shipments after 2025, while the share of AMOLED displays declines. Although AMOLED has become the dominant technology for high-end smartphones, it does not offer a pixel density high enough to completely suppress the screen door effect when using more compact optics.

SiOLED has been a niche display market dominated by Sony in consumer applications. However, the report finds that over $5B has been invested since 2017 to build new SiOLED fabs in China. This significant increase in capacity will drive a wider adoption of the technology and lower costs. SiOLED display shipments for AR/VR were below 1M last year but will grow to over 19M units by 2025.

DSCC has quickly become the leading market research provider for the display industry. DSCC has market reports for smartphones and TVs, and covers all the emerging display technologies, including MicroLED, MiniLED and foldable OLED. With the new Augmented and Virtual Reality Display Technologies and Market Report, DSCC is extending its analysis to the exciting and fast growing AR/VR market.

The report gives a complete picture of the various display technologies used in AR/VR, including LCD, AMOLED, LCoS, DLP, LBS, MicroLED and SiOLED. It profiles the key suppliers and their roadmaps. A description of the various optical configurations and waveguide types is also included. Market forecasts for both AR and VR are segmented by display types and show the technologies that will generate the most revenues.

DSCC will also dedicate a session on AR/VR at the SID Business Conference on May 17th, featuring leading analysts and technology companies. The virtual conference is part of Display Week 2021, the world's leading event focused on emerging electronic display and visual information technologies from concept to market. The agenda for the conference, including a list of 40 confirmed speakers can be found on the DSCC website.

About DSCC

DSCC, a Counterpoint Research Company, is the leader in advanced display market research with offices across all the key manufacturing centers and markets of East Asia as well as the US and UK. It was formed by experienced display market analysts from across the display supply chain and delivers valuable insights, data and supply chain analyses on the display industry through consulting, syndicated reports and events. Its accurate and timely analyses help businesses navigate the complexities of the display supply chain.