Ross Young

ross.young@displaysupplychain.com

FOR IMMEDIATE RELEASE: 11/30/2021

Q3’21 Was a Record Quarter for Foldable Smartphones, Samsung Enjoys a 93% Share per DSCC Report

Austin, TX -

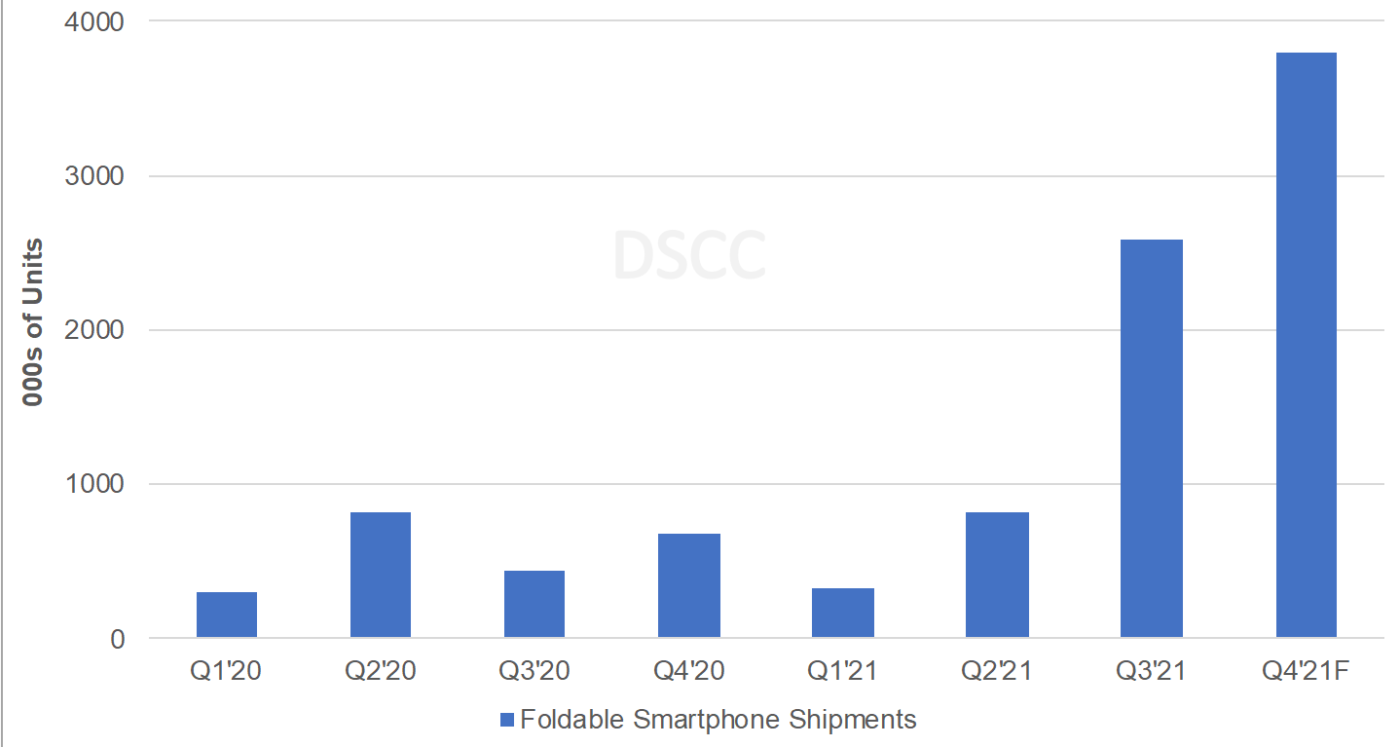

Q3’21 was a record quarter for foldable smartphone shipments as expected, given the successful launch of the Samsung Galaxy Z Flip 3 and Z Fold 3 as revealed in DSCC’s latest Quarterly Foldable/Rollable Display Shipment and Technology Report. How strong was it? “Q3’21 foldable smartphone shipments were larger than the previous four quarters combined and grew 215% Q/Q and 480% Y/Y to 2.6M phones. Samsung accounted for a 93% share of foldable smartphone shipments with Huawei #2 at 6%. Samsung’s August release of its improved foldables, the Galaxy Z Flip 3 and Z Fold 3, at more attractive prices along with strong promotional efforts and attractive trade-ins ensured the unprecedented growth of the foldable market. Furthermore, additional growth is expected in Q4’21 when the products are available for a full quarter,” according to DSCC Co-Founder and CEO, Ross Young.

Foldable Smartphone Shipments

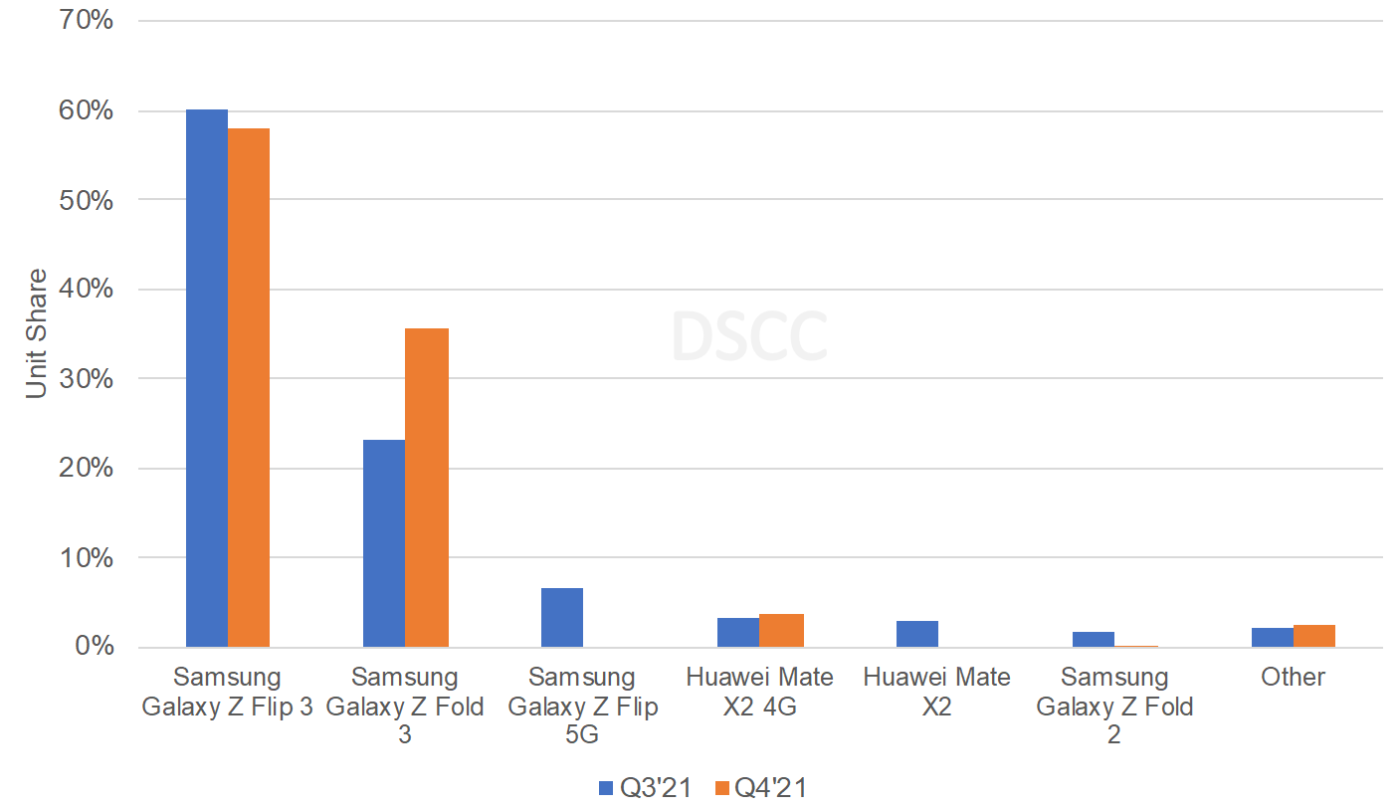

By model, the Samsung Galaxy Z Flip 3 led the way with a 60% share helped by its $999 price, 31% lower than the Z Flip 5G, as well as a larger and more functional front display, brighter main display with a variable refresh of up to 120Hz, water resistance and increased ruggedness. It was followed by the Z Fold 3 at a 23% share whose price fell by 11% vs. the Z Fold 2 and now features pen input, an under panel camera, water resistance, increased brightness and ruggedness, etc. The Z Flip 5G was the third best-selling model in Q3’21 with a 7% share followed by the Mate X2 and X2 4G at 3% each. In addition, it wasn’t just the Samsung brand that dominated the Q3’21 foldable market with Samsung Display accounting for 95% of Q3’21 foldable panel shipments.

According to DSCC’s new report, Q4’21 will also be a record for foldable smartphone shipments, which are expected to rise another 47% Q/Q and over 450% Y/Y to 3.8M units. Samsung’s share is expected to reach 95% in Q4’21 on its big marketing push, boosting awareness and improving affordability of the rapidly emerging category. The Z Flip 3 is expected to remain dominant in Q4’21 with a 58% share followed by the Z Fold 3 rising to 36% and the Mate X2 4G at 4%.

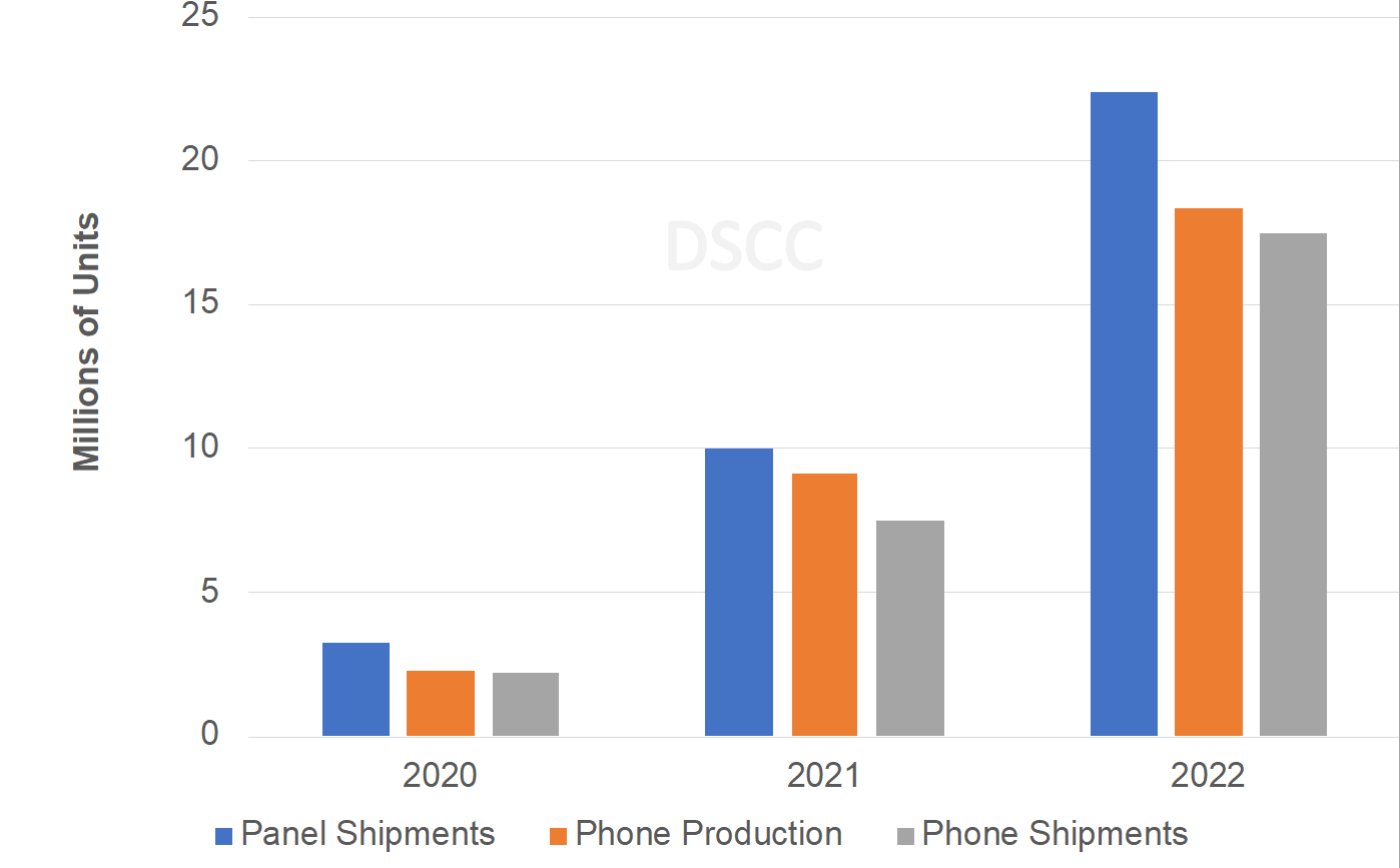

Foldable Smartphone Share by Model

For all of 2021, DSCC has slightly increased its foldable shipment forecast with Samsung’s success somewhat offset by delays at other brands because of the semiconductor shortage. DSCC now sees foldable smartphone shipments rising 241% to 7.5M units. For 2022, DSCC has raised its forecast to 17.5M foldable smartphones, now rising 132%, as Samsung expands its 2022 target, products/volumes delayed by the IC shortage move to 2022 and additional products are launched in 2022.

Foldable Smartphone Panel Shipments, Production and Shipments

DSCC’s latest Quarterly Foldable/Rollable Display Shipment and Technology Report also reveals:

- Regional shipments for the Z Flip 3 and Z Fold 3 by quarter;

- Specifications of foldable smartphones expected to be released in the next 12 months from:

- Oppo

- Honor

- Huawei

- Xiaomi

- Motorola

- Quarterly forecasts by model for all foldable smartphones through Q4’22 and annually through 2026;

- Cost premiums for 120Hz/LTPO, UTG and color on encapsulation by year out to 2025;

- Panel price forecasts by application, size, resolution, etc., out to 2026;

- Outlook for SCHOTT and Corning’s UTG volumes/share at Samsung;

- Latest forecasts for foldable tablets and notebooks and rollable TVs;

- China Star’s latest developments shown at its DTC event, outlook for IGZO foldable backplanes and the power saving benefits from auxiliary electrodes in larger OLEDs.

For more information on the Quarterly Foldable/Rollable Display Shipment and Technology Report, please contact info@displaysupplychain.com.

About DSCC

DSCC, a Counterpoint Research Company, is the leader in advanced display market research with offices across all the key manufacturing centers and markets of East Asia as well as the US and UK. It was formed by experienced display market analysts from across the display supply chain and delivers valuable insights, data and supply chain analyses on the display industry through consulting, syndicated reports and events. Its accurate and timely analyses help businesses navigate the complexities of the display supply chain.